How Can I Improve Business Cash Flow?

You know you need to get a handle on your business’s cash management, but the thought of it makes you want to run a mile. Where do you even begin? What if it’s a total mess? What if someone like me comes in and tells you it’s worse than you thought?

Here’s the thing: most business owners I work with are switched on, brilliant people. But they either:

- Don’t know where to start with managing their cash.

- Don’t want to look because they’re scared it’s a car crash, or

- Just don’t have the time because they’re too busy running the bloody business.

And that’s fair. But you can do it. You just need to start simple.

Tips to help with Cash Management

In this blog I’ll help you zoom out and take practical steps to help ease your cash flow:

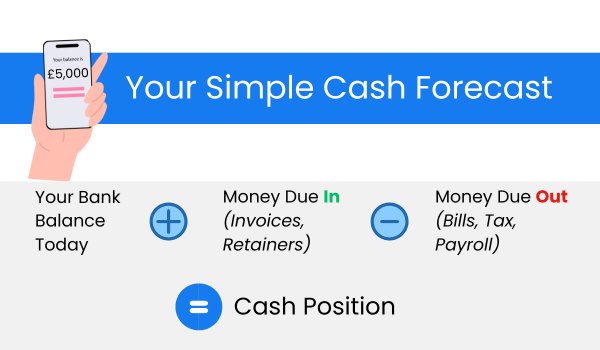

Step 1: Start With Your Bank Balance

Yes, it really is that simple.

Look at what’s in your business bank account right now. That’s your starting point. Then ask yourself:

What money is due to come in? (Invoices, retainers, regular payments)

What’s due to go out? (Bills, payroll, tax, subscriptions, your own drawings or dividends)

From there, you get your basic picture: Bank balance + what’s coming in − what’s going out = your cash position.

And no, you don’t need a 47-tab spreadsheet. Just grab a pen and paper or a simple Google Sheet. Done is better than perfect.

Step 2: Look Ahead, But Not Too Far

You don’t need to plan the whole financial year. Just look at the next 4 weeks. What’s likely to happen?

Are you expecting income? Be realistic. If you’ve been turning over £25k a month, don’t suddenly stick in £50k unless you know exactly where it’s coming from.

What expenses are coming up? Anything out of the ordinary?

Keep it simple. Keep it true. This is about getting real.

Step 3: Don’t Wait for it to be Perfect

Here’s where most people get stuck. They say:

“I’ll look at it next week when I’ve got more time… when I’ve pulled all my invoices together… when I feel more ready.”

Sound familiar?

I had a client the other day. Lovely woman. Smart. Been in business for years. We have fairly regular meetings, but she’d gone quiet, and I gave her a quick call. She said, “I know I need to do it, but I just haven’t got everything sorted yet.”

My answer? Book the meeting anyway.

Even if it’s not all done, even if it feels messy – let’s just get started. It doesn’t have to be perfect. It just has to begin.

Step 4: Get Honest with Yourself

Forecasting isn’t about making the numbers look good. It’s about:

- Knowing what’s actually coming in,

- Knowing what’s going out, and

- Figuring out what you’re left with at the end of the week or month.

If you want to pay yourself more (and let’s be honest, that’s the goal), you’ve got to get on top of this… and you can do it.

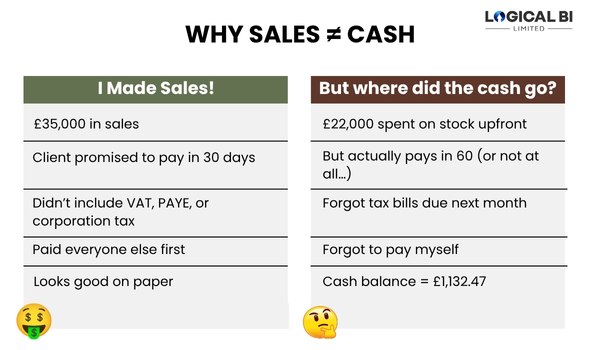

But I’m Making Sales, So Why Am I Still Skint?

This is one I hear all the time:

“I’m making sales every month… so why does it still feel like there’s never any money?”

Because sales aren’t the same as cash.

Your cash can disappear fast if:

- You’re buying stock up front with long lead times

- Your customers are slow to pay (or worse, don’t pay at all)

- You’ve forgotten to factor in VAT, corporation tax or other bills

- You’re not paying yourself consistently (or paying everyone else first!)

- Sales feed the business. But cash is what keeps it alive.

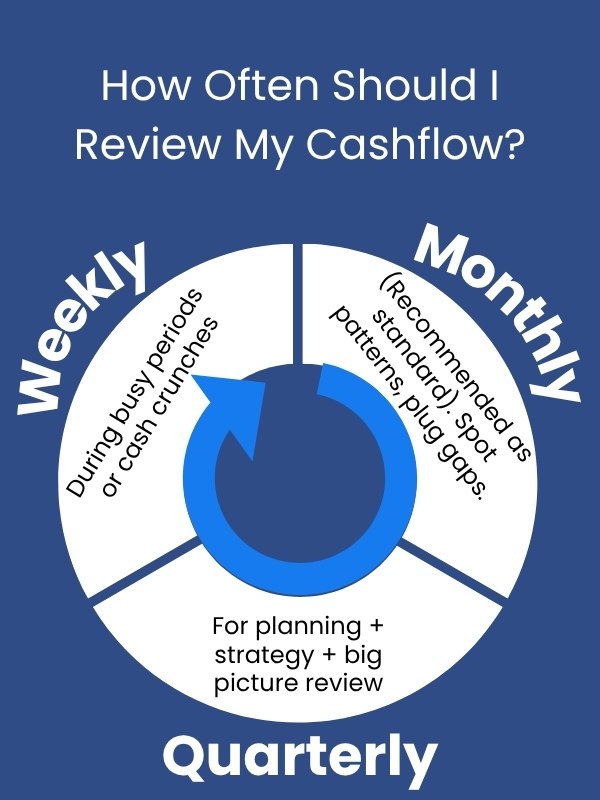

How Often Should You Be Reviewing Your Cash Flow?

More than once a year – let’s start there!

In an ideal world? Monthly. That way, you’re always ahead of the game. You can spot gaps, make better decisions, and sleep at night knowing where you stand.

Some of my clients check in weekly during busy periods. Others work with me on a quarterly review basis to stay aligned with their wider strategy.

Whatever the rhythm, the key is consistency. Set a recurring date in your calendar and stick to it.

Still Overwhelmed? That’s What I’m Here For

You don’t have to do this alone.

Whether you want a one-off cash forecast or someone to keep you accountable every month, that’s what I do.

I care about your cash. I won’t judge. I won’t make you feel daft. I’ll just help you see what’s really going on – and give you a practical plan to fix it.

Let’s Get Started

Check out my Cash Booster Consultancy Call , or book a free discovery call so we can decipher the main focus of your cash management issues.

Remember: cash doesn’t wait until you’re ready. So don’t wait either.

Additionally, if you have a manufacturing and distribution business, you may find our article: How poor inventory planning can kill cash flow.