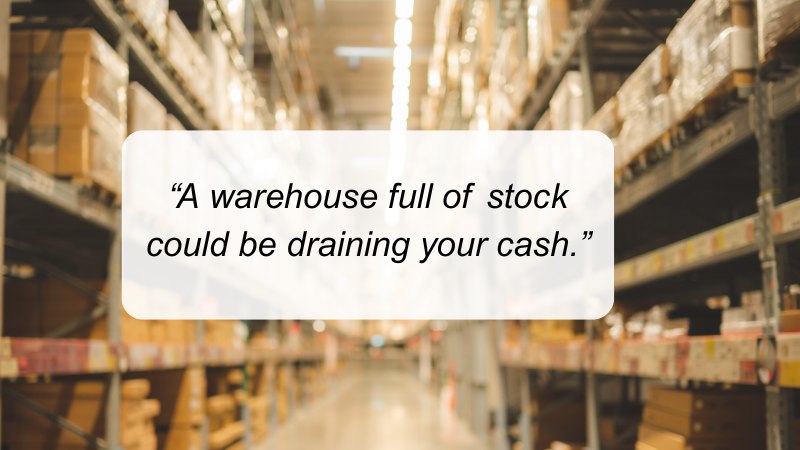

If your warehouse looks full but your bank account doesn’t… you’re not alone.

Many manufacturing and distribution businesses find themselves in this exact position: shelves stacked, suppliers paid, but cash flow still squeezed. Inventory decisions made without forward planning can quietly eat into your margins and tie up the cash you need to grow, invest – or simply breathe.

Let’s break down why this happens and, more importantly, what you can do to fix it.

Inventory Might Be the Culprit - Not the Economy

It’s tempting to point the finger at outside forces when cash feels tight: supply chain delays, rising costs, or that client who always pays late. But often, the real issue is lurking inside your warehouse.

Too much cash is locked in stock – and without clear inventory cash flow visibility, it’s impossible to see how that will play out. You’re left guessing how shifts in sales volume, supplier lead times, or production delays will impact your working capital.

The Forgotten Materials & Components

And let’s not forget about those raw materials or component parts. They might not be ready-for-sale items, but they tie up serious cash – especially if you’ve bulk-bought to “get a deal” or overestimated demand.

This is where robust stock and cash forecasting comes into play. If you can’t map how your stock turns back into cash – and when – you’re always chasing your tail.

Why Forecasting Beats Firefighting

When you’re not forward planning, you’re constantly reacting. One late shipment, and suddenly you’re juggling supplier payments, staff wages, and customer delivery dates – all without a clear view of how it affects your bottom line.

This kind of chaos creates more than operational stress – it impacts your ability to fund growth, invest in improvements, or even sleep at night.

What you need is a model that links sales forecasts, purchasing plans, stock movements, and payment terms into one clear, real-world view. Not just “what might happen,” but “what will this actually do to my cash?”

That’s manufacturing cash flow planning – and it’s what separates confident businesses from constantly stressed ones.

Working Capital Isn’t Just a Buzzword

It’s your lifeblood. And in manufacturing, your working capital can vanish fast if you’re not watching how it moves through your supply chain.

Are you overstocking? Are customer terms too generous compared to how quickly you’re paying suppliers? Are you investing in the wrong areas?

A full review of your working capital cycle – including inventory, debtors, and creditors – helps pinpoint cash leaks and highlight smarter ways to fund day-to-day operations.

Consider Options like Trade Finance

If you’re relying on loans or dipping into reserves just to bridge the gap between stock purchase and customer payment, there’s a better way.

Options like trade finance, asset-based lending, or supplier negotiations might help you free up cash without piling on debt. But to know which option fits, you need a clear picture of your current cash cycle.

Spoiler: That’s where a solid CFO-style review can make all the difference.

What you can do Right Now

Here are three practical steps you can take to improve your inventory and cash position – starting today:

1. Link Inventory to Your Sales Forecast

Look at what you’re projecting to sell over the next 3–6 months. Is your current stock aligned with that? Are you over-ordering because “that’s what we’ve always done”? Match your purchasing plan to your sales pipeline – not just your gut feeling.

2. Revisit Supplier Terms

Some of the biggest gains in inventory management finance come from small tweaks to supplier terms. Can you negotiate longer payment periods? Reduced minimum order quantities? If your current terms are based on assumptions from three years ago, it’s time to review.

3. Map Out the Cash Impact of Delays

What happens if a key supplier is late by two weeks? Or your biggest client slows their payment run? Mapping out different “what if” scenarios helps you plan ahead and build buffers into your cash flow forecast.

4. Identify your Inventory “Dead Zones”

Run a simple report showing items with no movement in the last 90 or 180 days. These are your cash traps. Once you’ve identified them, consider markdowns, bundling them with faster-moving items, or halting further orders until stock levels are under control.

The Hidden Cash Cost of "Business as Usual"

A warehouse full of stock might look like a strength. But if it’s not backed by solid planning, it can quietly drain your cash, trigger borrowing, and create a never-ending cycle of stress. Most business owners we work with don’t have a stock problem – they have a visibility problem.

When you can see the full picture – how sales, purchasing, and stock all flow together – you can make smarter decisions and stop cash from slipping through the cracks. This full picture view is the foundation of strong manufacturing working capital management.

Real-Life Example: The Warehouse That Ate the Profit

A recent client came to us with decent turnover, a busy warehouse, and… constant cash issues. On paper, everything looked fine. But a deep dive showed stock levels that were out of sync with sales. They were buying too much, too soon, tying up cash that could have gone towards staff, suppliers, or strategic growth.

We overhauled their stock and cash forecasting, reviewed supplier terms, and introduced rolling cash flow planning. Within weeks, they had clearer visibility, more headroom – and far less stress.

When Sales Grew but Cash Shrunk

Another client in precision components saw a sharp increase in sales but was still dipping into their overdraft each month. The culprit? Their purchasing team was ordering based on annual sales targets rather than monthly cycles. This led to massive upfront stock spends, months before invoices were raised or paid.

We helped them shift to phase-based ordering aligned with cash-in timing, which freed up over £180k in working capital in the first quarter alone. But that wasn’t all.

To create further breathing space, we reviewed their financing setup. By introducing a trade finance facility, they gained access to short-term supplier payments without tying up their own funds, ideal for covering large upfront costs from overseas vendors.

Drawing Funds as Goods are Shipped

We also added a revolving credit line secured against their stock in transit, which meant they could draw down funds as goods were shipped – rather than waiting until stock arrived or was sold. These changes reduced pressure on the overdraft, improved supplier relationships, and unlocked a more resilient manufacturing working capital position.

Need a Hand?

If all this still feels like a lot, you’re not alone. Most of the manufacturing businesses we work with didn’t realise how much cash was being lost through stock decisions – until we showed them the numbers.

At Logical BI, our Manufacturing & Distribution Finance Consulting service is designed to take the guesswork out of your inventory and cash flow.

We build forecasting models, review working capital cycles, and help you weigh up funding options with real-world clarity – so you can move from reactive to proactive.

Book a FREE Call

We would be more than happy to discuss the issues holding your business back with a free consultation call. OR book a free 30-minute Cash Flow Audit with a CFO who understands manufacturing and distribution.